A Unique Language-Agnostic Approach Enables Rapid Addition of New Languages On-Demand

MENLO PARK, Calif., February 23, 2021 /PRNewswire/ — Quantifind, a provider of a SaaS solution used by banks to automate name screening and financial crimes investigations, announced that it has added support for search and analysis of Chinese-language data sources to its Graphyte™ platform. The new capability adds billions of public records that significantly improve the accuracy and confidence of risk assessments used to detect and investigate financial risk and crimes as part of KYC and AML efforts.

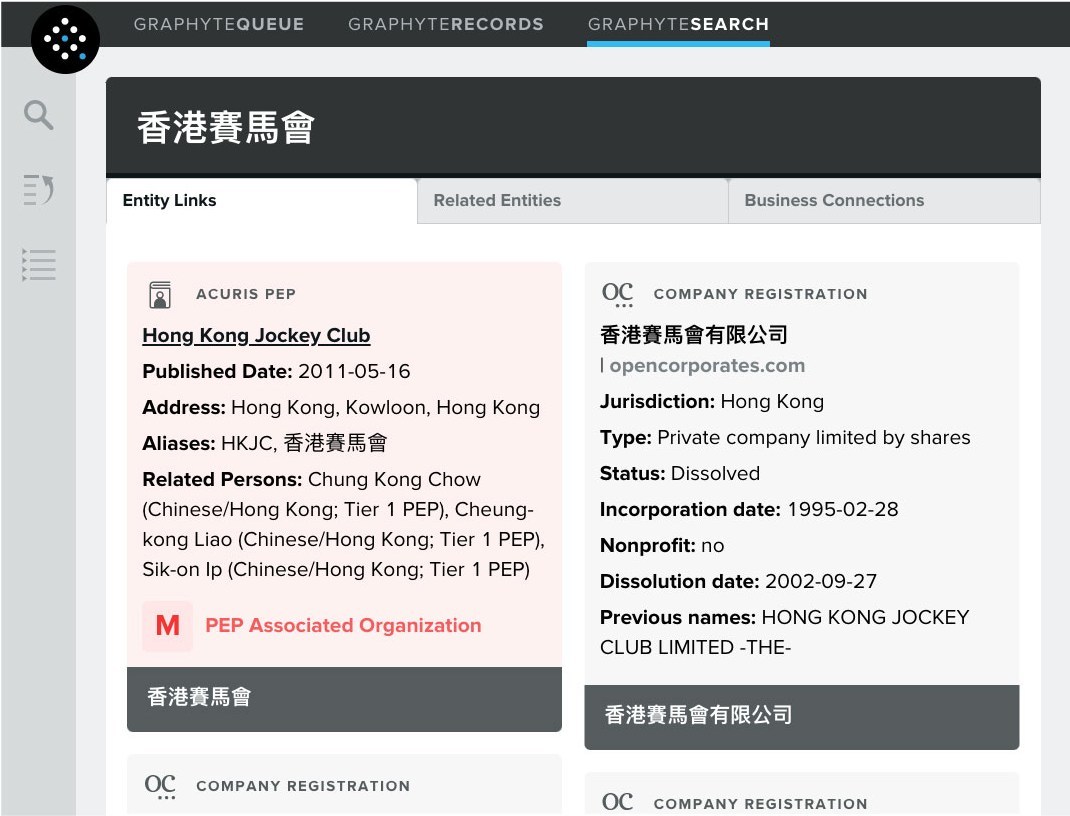

Analysts can now enter their person- or organization-based queries with romanized pinyin, traditional, or simplified Chinese characters into the GraphyteSearch web application, and receive results in Chinese characters that are translatable on the fly. The addition of Chinese demonstrates the impact of Quantifind’s unique language-agnostic approach in enabling rapid addition of support for new languages on demand.

“Chinese language support opens up a wealth of data that is extremely useful in investigating global financial crimes that are otherwise obscured,” commented Ari Tuchman, CEO of Quantifind. “We are proud of our ability to add new languages so quickly, even with non-Latin characters. We remain customer-driven and have a pipeline of requested languages that we will continue to roll out.”

About the Graphyte Platform

Graphyte drives automation in anti-money laundering and fraud investigations by automatically extracting predictive risk signals from vast stores of structured and unstructured public data. By automating risk monitoring and investigation processes, Graphyte customers are able to focus their resources on their highest-risk transactions and have seen efficiency gains as high as 40%. Integrations with leading case management systems make synchronous and batch-based risk summaries available to investigators within their established tools and workflows.

Graphyte leverages state-of-the-art entity resolution models learned over millions of training samples and applied in real time. Unlike other negative news scans or watchlist screening solutions, Graphyte uses artificial intelligence to solve for both accuracy and relevance. Its data sources include all of the relevant sanctions and watchlists but also online news in English, Spanish, French, and now Chinese, as well as company data, legal entity registrations, and non-standard entity lists.

About Quantifind

Quantifind was founded in 2009 upon pioneering work building machine learning technology to discover meaningful patterns across large, disparate, unstructured datasets. Through continued growth in multiple industries, Quantifind built a SaaS platform to address financial risk management and anti-money laundering by helping banks improve the efficiency of their AML investigations. It replaced out-of-date tools that lacked the data coverage, accuracy, and features that investigators needed to be effective as transaction volume grew.

Today, Quantifind’s platform embodies over a decade of R&D and deployment experience in machine learning, natural language processing, risk modeling, name science, and entity resolution, and is helping many large financial institutions and law enforcement agencies combat financial risk and crime. Its success is rooted in its fusion of science with design; machine learning innovations with intuitive, feature-rich web applications and APIs.

Quantifind is headquartered in Menlo Park, California, with teams in Boston, New York City and Washington, D.C. Learn more about Quantifind and request a demo at www.quantifind.com.