Adverse media screening doesn’t need to be just a primitive comparison of names against curated watchlists, or a limitless open source search full of diversions and distractions. Quantifind offers a better way to ensure you’re not banking criminals.

Graphyte™ is Quantifind’s adverse media screening and investigations platform. It’s being used today by Tier 1 banks, regional banks, and neobanks to perform daily monitoring of adverse media for tens of millions of customers, and has been proven to increase the productivity of their investigation teams by over 40%. It’s the same technology selected by the Department of Defense among dozens of alternatives to help uncover criminal networks.

Here are a few of the ways that Quantifind’s decade-plus of data science R&D and Fortune 50 deployments have changed the paradigm for adverse media screening:

The Old Way

- Screening service combining software and analysts; prone to worker disruptions and requiring data sharing outside of jurisdictions.

- Results with the wrong person or company identified 90% of the time.

- Human-curated lists of bad actors that quickly become outdated, in the model of PEP and sanctions screening.

- Manually created, narrowly defined, static risk definitions that miss emergent threats.

- Google searches required to confirm hits and add context before decisioning; wasted time, inconsistent process, and non-secure methods.

- Search machine-translated foreign-language sources for Anglicized names with English-only risk assessment.

- Simple fuzzy matching algorithms and string distance metrics, unaware of cultural name variant conventions or name prevalence.

Graphyte™

- 100% subscription-based SaaS solution with end-to-end encryption.

- AI-driven, high confidence entity resolution with 90% accuracy.

- Limitless risk assessments generated in real time using all available data, powered by full-text search against millions of articles.

- Dynamic risk typologies that evolve with the threat space.

- Programmatic search performed anonymously and integrated with open source searches; review of only relevant results in a single purpose-built application.

- Search foreign-language sources and assess risk in the native languages, using non-Roman character sets including Chinese.

- Name science quantifies expected name variants and name frequency within a specific country to assess the probability of a true match.

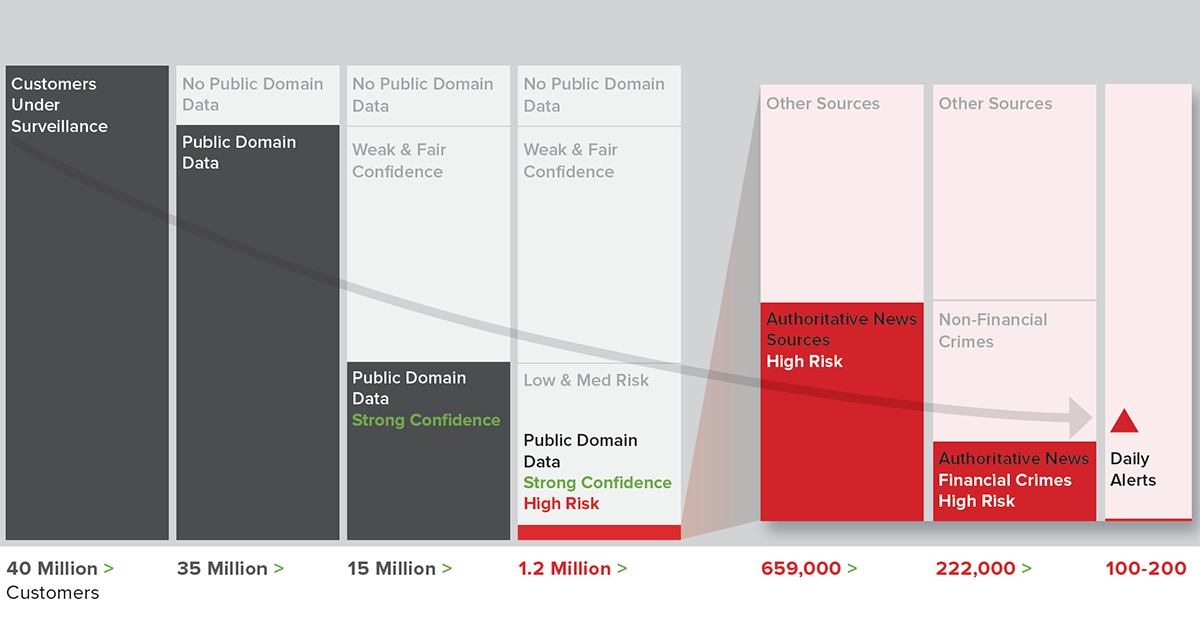

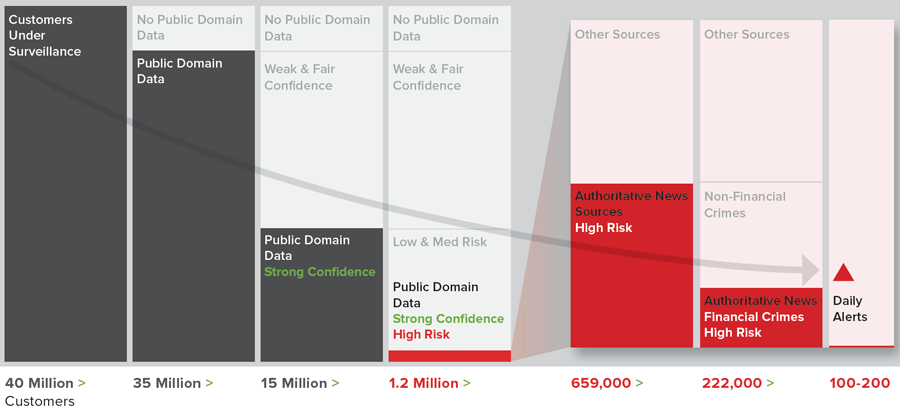

AI enables continuous customer monitoring at scale.

Graphyte uses a unique combination of external data sources, predictive risk typology models, and patented data management technologies to inform risk profiling and segmentation. The speed and accuracy achieved enables automation of ongoing continuous monitoring at scale. Results are summarized via Graphyte APIs and through the GraphyteSearch investigation application. Actionable information on individuals, organizations, and their relationships expands coverage to better manage reputational risk and fraud. Machine learning models and risk typologies optimize accuracy and relevancy ensuring that ongoing alerts are on target. Necessary transparency is provided for these models and risk typologies to satisfy internal and external model risk management requirements.

Contact Quantifind to learn more about how Graphyte’s unique AI technology and software-only approach makes customer surveillance so efficient, even with tens of millions of customers.