Sanctions enforcement is entering a new era. As geopolitical tensions deepen and evasion tactics grow more sophisticated, financial institutions must rethink how they manage risk. At a recent Sanctions Convergence event hosted by Quantifind and Protiviti, a panel of experts from financial services, government, and technology shared their perspectives on what lies ahead for sanctions compliance.

Their message was clear: the next five years will bring major shifts that demand smarter, faster, and more adaptive programs.

Here are five forces set to influence sanctions compliance.

- Evasion Tactics Will Grow More Complex and Networked

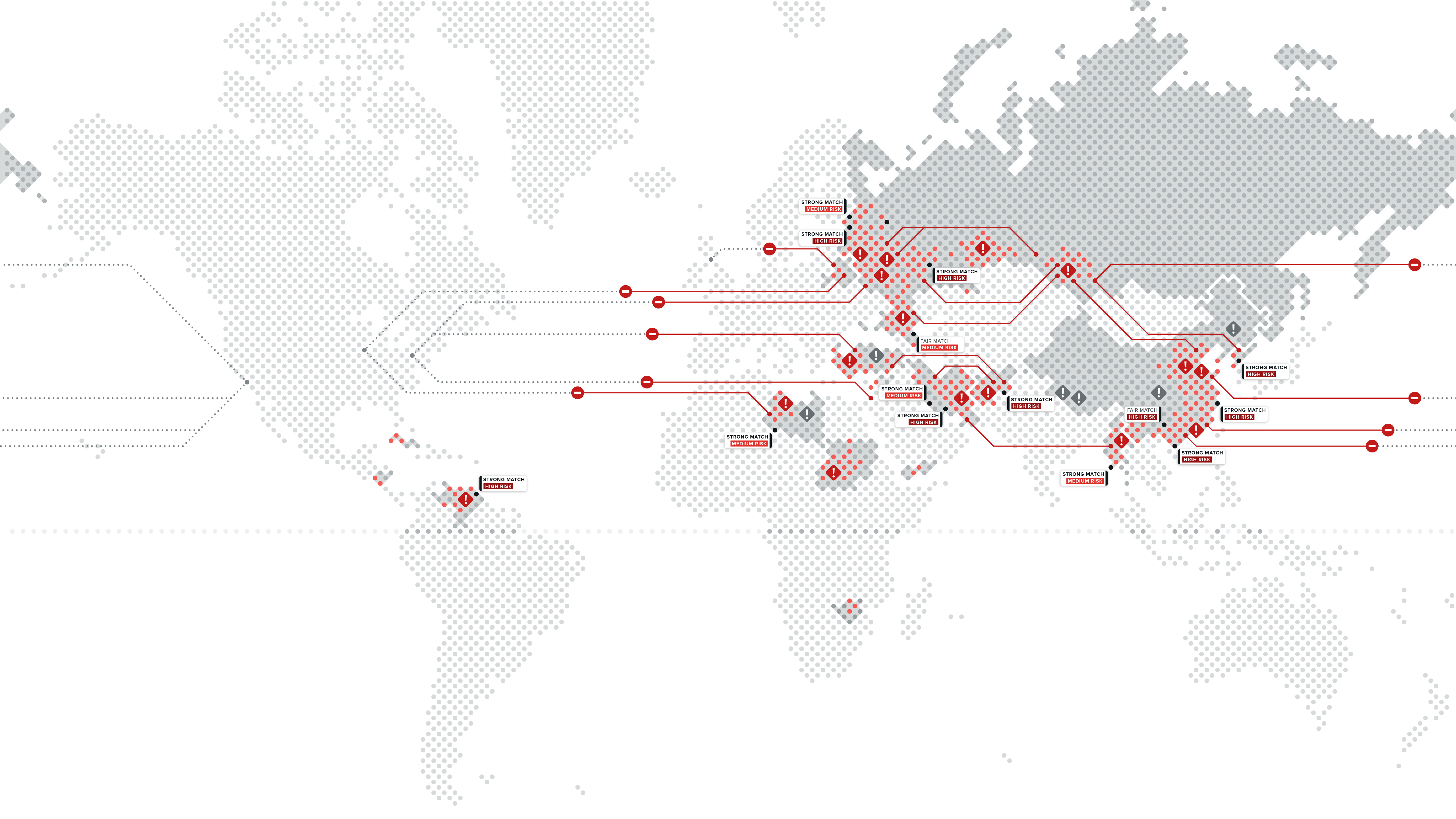

Criminals are becoming more agile. The panel highlighted how networks now blend traditional and emerging techniques, combining layered ownership structures, shell companies, crypto, and multi-jurisdictional trade routes.Tracking these evasive moves will require compliance programs to adopt more dynamic, intelligence-driven approaches. The old playbook of static lists and rules will not keep up.

The takeaway: Expect more sophisticated evasion patterns that will demand advanced detection capabilities and network-level analysis. - AML and Sanctions Teams Break Down Silos

Historically, anti-money laundering and sanctions compliance operated on separate tracks. That may change. The Ukraine and Middle East crises exposed how intertwined these risks can be. The designation of several drug cartels as Specially Designated Global Terrorists (SDGTs) means risks straddle both AML and sanctions domains, forcing institutions to adopt a unified view of financial crime risk.

The takeaway: Future-proof programs will integrate AML and sanctions operations, leveraging shared data, shared tools, and cross-functional expertise. Sanctions teams require increasingly more developed tooling to understand sanctions evasion risk. - Regulatory Pressure Will Continue to Rise

Regulators now expect faster, more accurate detection and reporting. They are becoming more sophisticated in their reviews and raising the bar on expectations, particularly as priorities expand to include areas like tariff evasion and export controls.At the same time, public scrutiny has intensified. Institutions face growing reputational risk if they fall behind. Compliance teams will need to modernize or risk being left exposed.

The takeaway: Programs must evolve to deliver both real-time insights and robust governance, with faster responsiveness to emerging risks. - AI Will Move from Experiment to Essential Infrastructure

AI has shifted from an emerging curiosity to a critical capability for modern compliance. The scale and complexity of today’s risks simply outpace human review and static systems.AI-driven tools for name matching, entity resolution, and network analysis will be key to maintaining effective controls. The challenge will be to implement AI responsibly, with explainability and clear governance at the core.

The takeaway: Institutions that embrace AI thoughtfully will gain a vital edge in managing sanctions risk. Those who delay will fall behind. - Global Sanctions Divergence Will Add Operational Complexity

Global alignment on sanctions, which surged after Russia invaded Ukraine, is already showing signs of divergence. Shifting political priorities between the U.S., EU, UK, and other jurisdictions will create new operational hurdles for multinational institutions.Managing divergent lists, licensing regimes, and enforcement expectations will require highly flexible compliance systems.

The takeaway: Institutions must prepare for a world where sanctions compliance is increasingly complex and multi-regional, with rising demands on agility and adaptability. These changes require a program to be able to flex to varying workloads rapidly.

Conclusion:

The path forward is clear. Sanctions compliance must evolve to meet new challenges in speed, scale, and sophistication. AI will play a central role, but equally important will be smarter integration of data, closer collaboration between AML and sanctions teams, and proactive engagement with shifting regulatory expectations.

Financial institutions that take action today will likely be well-positioned for what lies ahead. Those that wait risk being caught off guard.

Want to learn how Quantifind’s AI-driven solutions can help your organization stay ahead of these changes? Connect with one of our experts.

Need assistance in assessing your AML and Sanctions programs and finding ways to enhance your risk management capabilities? Connect with our trusted partner at Protiviti: Financial Crimes Compliance Consulting